How to Protect Your Income with Disability Insurance

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

- Secure up to $1,000,000 in life insurance for your family

- Apply with a 60-second online questionnaire

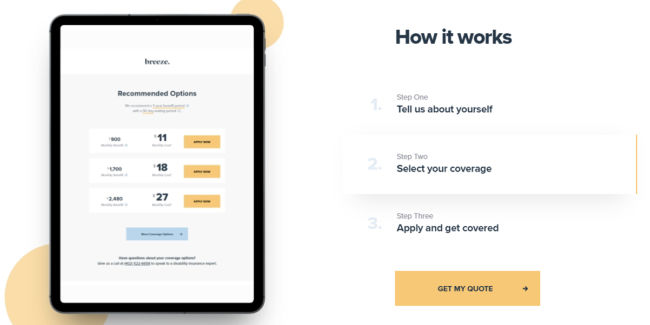

- Policies start at $11 per month

- No medical test needed, no waiting, no hassles

Do I really need disability insurance?

- 25% of Americans will experience a disability in their careers before retirement (U.S. Social Security Administration, Fact Sheet, 2018)

- In 2020, 21.5 million employed adults aged between 18-64 in the U.S. had some form of disability. (Centers for Disease Control and Prevention)

- 90% of long-term disabilities result from illnesses rather than accidents (Council for Disability Awareness, 2018)

- 70% of working Americans couldn't make it a month without a paycheck before experiencing financial hardship (Life Happens survey, 2018)

- 68% of people will not be able to cover just one month’s living expenses if they lose their primary source of income (Bankrate Annual Emergency Fund Report, 2023)

People LOVE Breeze as well.

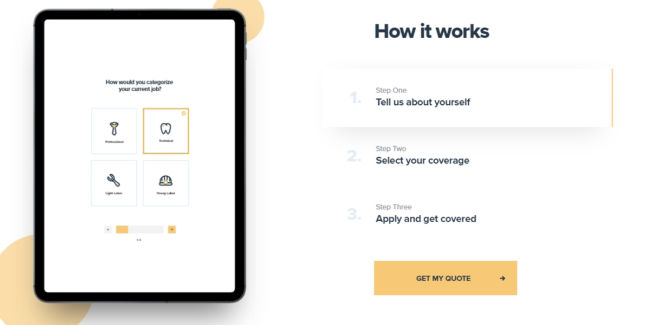

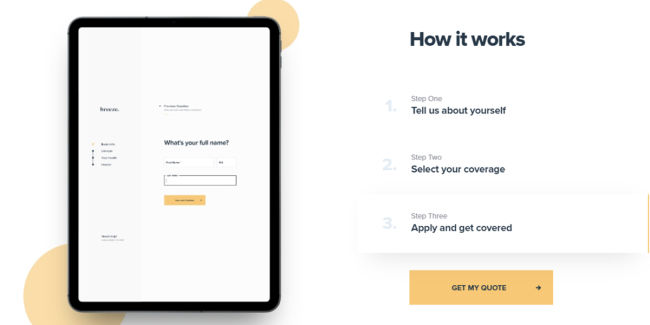

How Do I Use Breeze?

Joy Wallet’s Top Tips & Tricks

- Secure up to $1,000,000 in life insurance for your family

- Apply with a 60-second online questionnaire

- Policies start at $11 per month

- No medical test needed, no waiting, no hassles

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

We are entrepreneurs, investors, fintech enthusiasts, journalists, and masters of aggregating and deciphering data. We have been working in the financial services industry for over seven years and wanted to build a place where we can bring together the brightest minds and organizations to help you make more money.

With access to the right opportunities, you can take care of the ones you love and create a more prosperous lifestyle. We made Joy Wallet out of a desire to find the best financial partners, strategies and tools to help you achieve your life goals and make the most of money.